There were minor modifications announced by RBI in the risk weights for housing loans. (Link: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=10063&Mode=0)

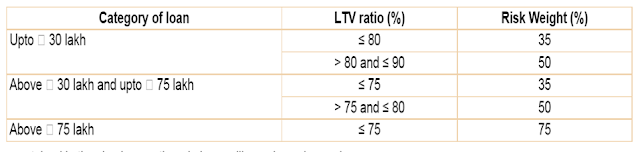

I am providing a snapshot herewith.

The first change was increasing the slab to 30 lakhs from 20 lakhs. The second change is risk weight is reduced to 35% from 50% for lower LTV ratio categories.

Few primers before we begin. LTV is loan to value ratio, for a house costing or valued at 30 lakhs, one would get a loan of 80% that is 24 lakhs at 80% LTV. For this 24 lakh loan, if risk weight assigned is 50%, then 12 lakh amount of loan is at risk which needs to be covered with a Capital Adequacy Ratio (CAR) set at 9%. That comes to Rs.1.08 lakh which banks needs to set aside as reserve for each Rs. 24 lakh loan.

Now let us rerun the math for the change in policy. Since risk weight is reduced to 35% from 50% for two categories, for the same Rs. 24 lakh loan, amount at risk reduces to 8.4 lakhs (from 12 lakhs) and the reserve required comes down to Rs. 75,600 (from 1.08 lakh). This differential money banks can use to lend that will increase their profits in the range of 10 bps to 30 bps (0.1% to 0.3%). Banks can choose to pass on this benefit partially or fully to the consumer too.

Changing the slab from 20 lakhs to 30 lakhs was necessary as land and construction costs have gone up. Personally I do not think houses at this price range carry the risk of 35% price drop in adverse situations. But banks and RBI need to be conservative. Probably measures like this have protected India from situation like subprime crisis when housing prices dropped significantly in US during 2008-09. Though it seems still high, reducing risk weight from 50% to 35% to low cost segment is definitely a welcome move.

Now with this change, consumers buying a house valued up to 37.5 lakhs (then the maximum loan will be 30 lakhs at 80% LTV) can benefit and banks would chase this segment as target base. Housing loans are a lion share in most banks loan portfolio and this change will improve liquidity and improve profitability too. If consumers borrowing less than Rs. 30 lakhs get a small rate differential, it would save them a few hundred rupees a month in the interest outgo. But not being denied the loan (even when eligible due to liquidity reasons) is the real benefit. Don’t be surprised if you begin to get calls from bank marketing channels offering you a housing loan at competitive rate. That is expected in the coming months. Distressed realtors too would roll out a red carpet when you go for a site visit.

Though RBI is aiming to make it easier for borrowers of low cost housing, we can observe that it has reduced risk weightage for loans above 30 lakhs too to 35% if LTV is at 75%. This would mean those making a 25% down payment on the houses costing in the range of Rs. 30 to 75 lakhs would also find it convenient to get loans. When credit growth at multiple years low, bond yields reducing, and improving liquidity situation, banks would not turn down the qualified customer. Instead they would outbid each other.

If we have affordability and need but don’t own a house yet, it is time to go out and build (or buy) our own houses. Lower rates, pampering by banks are cyclical. Consumer’s party has begun now and it is likely to stay for couple more years. Take benefit as long as it lasts and pay-off as much debt as possible too. When rates come back, it would not pain you as your loan principal would have been reduced. If you already own a house and have a loan, visit your bank to ensure you are getting revised lower rates. If not burdened, do not reduce your EMI, choose for reducing the loan period. In a 20 year loan period, one can see 3-4 cycles of rates going up and down. Keeping the EMI constant when rates are low helps to offset the burden when rates are high.

If you think all of this does not matter much, you will end up working for the bank more than for your home.

[I am not from banking background. I wrote this post to understand the policy changes better]

I am providing a snapshot herewith.

|

| Source: RBI |

Few primers before we begin. LTV is loan to value ratio, for a house costing or valued at 30 lakhs, one would get a loan of 80% that is 24 lakhs at 80% LTV. For this 24 lakh loan, if risk weight assigned is 50%, then 12 lakh amount of loan is at risk which needs to be covered with a Capital Adequacy Ratio (CAR) set at 9%. That comes to Rs.1.08 lakh which banks needs to set aside as reserve for each Rs. 24 lakh loan.

Now let us rerun the math for the change in policy. Since risk weight is reduced to 35% from 50% for two categories, for the same Rs. 24 lakh loan, amount at risk reduces to 8.4 lakhs (from 12 lakhs) and the reserve required comes down to Rs. 75,600 (from 1.08 lakh). This differential money banks can use to lend that will increase their profits in the range of 10 bps to 30 bps (0.1% to 0.3%). Banks can choose to pass on this benefit partially or fully to the consumer too.

Changing the slab from 20 lakhs to 30 lakhs was necessary as land and construction costs have gone up. Personally I do not think houses at this price range carry the risk of 35% price drop in adverse situations. But banks and RBI need to be conservative. Probably measures like this have protected India from situation like subprime crisis when housing prices dropped significantly in US during 2008-09. Though it seems still high, reducing risk weight from 50% to 35% to low cost segment is definitely a welcome move.

Now with this change, consumers buying a house valued up to 37.5 lakhs (then the maximum loan will be 30 lakhs at 80% LTV) can benefit and banks would chase this segment as target base. Housing loans are a lion share in most banks loan portfolio and this change will improve liquidity and improve profitability too. If consumers borrowing less than Rs. 30 lakhs get a small rate differential, it would save them a few hundred rupees a month in the interest outgo. But not being denied the loan (even when eligible due to liquidity reasons) is the real benefit. Don’t be surprised if you begin to get calls from bank marketing channels offering you a housing loan at competitive rate. That is expected in the coming months. Distressed realtors too would roll out a red carpet when you go for a site visit.

Though RBI is aiming to make it easier for borrowers of low cost housing, we can observe that it has reduced risk weightage for loans above 30 lakhs too to 35% if LTV is at 75%. This would mean those making a 25% down payment on the houses costing in the range of Rs. 30 to 75 lakhs would also find it convenient to get loans. When credit growth at multiple years low, bond yields reducing, and improving liquidity situation, banks would not turn down the qualified customer. Instead they would outbid each other.

If we have affordability and need but don’t own a house yet, it is time to go out and build (or buy) our own houses. Lower rates, pampering by banks are cyclical. Consumer’s party has begun now and it is likely to stay for couple more years. Take benefit as long as it lasts and pay-off as much debt as possible too. When rates come back, it would not pain you as your loan principal would have been reduced. If you already own a house and have a loan, visit your bank to ensure you are getting revised lower rates. If not burdened, do not reduce your EMI, choose for reducing the loan period. In a 20 year loan period, one can see 3-4 cycles of rates going up and down. Keeping the EMI constant when rates are low helps to offset the burden when rates are high.

If you think all of this does not matter much, you will end up working for the bank more than for your home.

[I am not from banking background. I wrote this post to understand the policy changes better]

Your blog seems interesting and information shared is really useful.Loans are important when you need a large amount of money. But before taking a loan you must know all aspect of it.

ReplyDeleteThanks for stopping by. Your feedback is of great value to me.

Delete